How to choose Best Insurance Policy for Your Business:

Introduction:

As a business owner, you know how important it is to protect your business from unexpected events that could lead to financial losses. That's why having the right insurance policy is crucial for your business's success.

But with so many insurance options available, choosing the best policy for your business can be a daunting task. That's where ChatGPT comes in. In this blog post, we'll explore ten tips for choosing the best insurance policy for your business, using insights generated by ChatGPT.

Identify your business's specific insurance needs :

The first step in choosing the best insurance policy for your business is to identify your specific insurance needs. This includes determining the types of risks your business faces and the types of coverage that will protect you from those risks. Use ChatGPT to generate prompts related to your business's industry and location, such as "What types of insurance do businesses in [your location/industry] need?" or "What are the most common risks for businesses in [your location/industry]?"

Consider your budget:

Once you've identified your business's insurance needs, it's time to consider your budget. Use ChatGPT to generate prompts related to your budget, such as "How much should I budget for insurance?" or "What types of coverage are most cost-effective for businesses like mine?"

Research different insurance providers :

Next, research different insurance providers and compare their policies and pricing. Use ChatGPT to generate prompts related to your research, such as "What are the top-rated insurance providers for businesses in [your location/industry]?" or "What are the pros and cons of different insurance providers?"

Read reviews and ask for recommendations:

Reading reviews and asking for recommendations from other business owners can also be helpful in choosing the best insurance policy for your business. Use ChatGPT to generate prompts related to reviews and recommendations, such as "What are the best websites for reading insurance reviews?" or "How can I ask for recommendations from other business owners?"

Understand the policy's coverage limits

It's essential to understand the coverage limits of your insurance policy to ensure that you're adequately protected in case of a loss. Use ChatGPT to generate prompts related to coverage limits, such as "What are the coverage limits for different types of insurance policies?" or "How can I ensure that I have enough coverage for my business?"

Review the policy's exclusions :

Be sure to review the policy's exclusions to understand what types of events are not covered by your insurance policy. Use ChatGPT to generate prompts related to policy exclusions, such as "What types of events are typically excluded from insurance policies?" or "How can I ensure that I'm aware of all the policy's exclusions?"

Ask questions:

Don't be afraid to ask questions about your insurance policy to ensure that you understand it fully. Use ChatGPT to generate prompts related to your questions, such as "What questions should I ask my insurance provider?" or "How can I ensure that I'm getting the right answers to my questions?"

Get multiple quotes :

Getting multiple quotes from different insurance providers can help you find the best policy for your budget and coverage needs. Use ChatGPT to generate prompts related to getting quotes, such as "What are the best websites for getting insurance quotes?" or "How can I compare different insurance quotes effectively?"

FAQ :

Q1: How do I determine the insurance coverage my business needs?

A1: Assess your business's specific risks and liabilities. Consider factors such as industry, size, location, and the nature of your operations. Consult with an insurance professional to help identify potential risks and determine the appropriate coverage for your business.

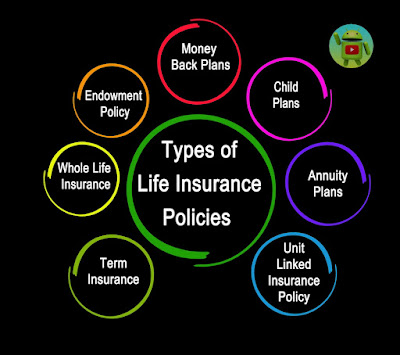

Q2: What types of insurance policies should I consider for my business?

A2: Common types of insurance policies for businesses include general liability insurance, property insurance, professional liability insurance (errors and omissions insurance), workers' compensation insurance, and business interruption insurance. The specific policies you need will depend on the nature of your business.

Q3: Should I choose a general insurance policy or opt for specialized coverage?

A3: It depends on your business. General insurance policies provide broad coverage for common risks, while specialized policies offer more specific coverage for industry-specific risks. Evaluate the unique needs of your business and consult with an insurance professional to determine the most suitable coverage options.

Q4: How can I ensure I'm getting the best insurance rates for my business?

A4: Shop around and obtain quotes from multiple insurance providers. Compare coverage options, deductibles, premiums, and additional benefits offered by different insurers. Consider working with an independent insurance agent or broker who can help you navigate the market and negotiate favorable rates on your behalf.

Q5: What factors should I consider when evaluating insurance providers?

A5: Look for insurance providers with a strong financial stability rating, a solid reputation for customer service, and a track record of efficiently processing claims. Additionally, consider the provider's experience in your industry and their willingness to tailor policies to meet your specific needs.

Q6: Is it necessary to review and update my insurance policies regularly?

A6: Yes, it's crucial to review your insurance policies periodically, especially when your business undergoes significant changes or expansion. This ensures that your coverage remains aligned with your business's evolving needs and adequately protects against potential risks.

Q7: What are some cost-saving strategies when purchasing insurance?

A7: Consider implementing risk management practices, such as safety training programs or security systems, to minimize potential risks and demonstrate to insurers that you are proactive about risk prevention. Additionally, bundling multiple policies with the same insurer or increasing deductibles can sometimes lead to cost savings.

Q8: Can I negotiate the terms and conditions of my insurance policy?

A8: In some cases, you may be able to negotiate certain aspects of your insurance policy, such as coverage limits, deductibles, or premium rates. Working with an independent insurance agent or broker can help facilitate these negotiations on your behalf.

Q9: Is it advisable to read the policy documents thoroughly before purchasing insurance?

A9: Absolutely. It's essential to read and understand the policy documents, including the terms, conditions, exclusions, and limitations. If you have any questions or need clarification, don't hesitate to ask your insurance provider or agent.

Q10: Should I seek professional advice when choosing insurance for my business?

A10: Yes, consulting with an insurance professional, such as an independent agent or broker, can provide valuable insights and guidance in selecting the best insurance policy for your business. They can help assess your needs, explain complex policy terms, and ensure you make informed decisions regarding your insurance coverage.

0 Comments